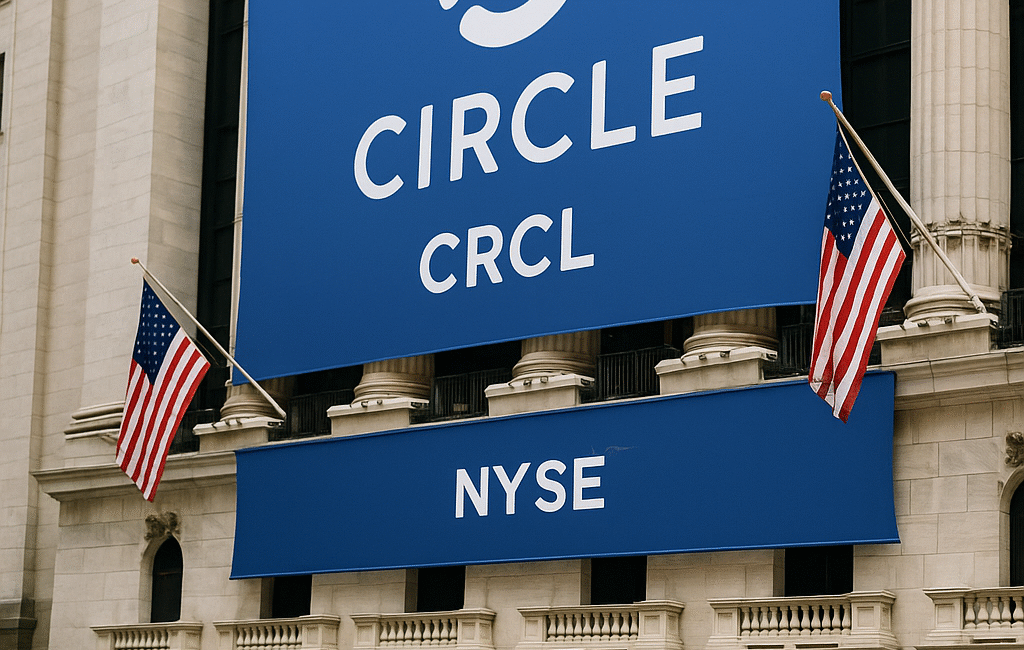

USDC's issuer, Circle, debuts on the NYSE with the ticker CRCL, targeting a valuation of 5.4 billion.

Circle, the issuer of the USDC stablecoin, has officially launched its IPO on the NYSE

under the ticker CRCL, aiming to raise about $600 million. The company's overall valuation is estimated at more than $5.4 billion, a significant milestone for a company that has been able to position itself in the competitive cryptocurrency market.

Circle will offer 24 million common shares, including 9.6 million issued by the company and 14.4 million sold by existing shareholders. An option to purchase up to 3.6 million additional shares is also planned, which could further increase the company's capital raised and liquidity.

The offering price of the shares is estimated at $24 to $26 per share

e Circle is aiming for capitalization in excess of $5.43 billion. About 240 million of the net proceeds will go to the company, while 360 million will go to shareholders. This strategic approach could strengthen Circle's position in the stablecoin market, where it currently holds a market share of $62.1 billion, compared to Tether's $238 billion USDT.

What is the impact of this IPO on the future of stablecoins?

The interest of institutional investors such as ARK Investment Management, which has shown interest in buying $150 million in CRCL shares, highlights the growing confidence in Circle's potential. This could mark a significant change in the way cryptocurrencies are perceived by traditional investors.

The implications of this debut are many

and could affect not only the stablecoin market, but also the entire cryptocurrency ecosystem. As regulation and demand for digital assets increases, Circle could become a benchmark for other companies that wish to follow in its footsteps.

In conclusion, Circle's IPO represents an important step not only for the company itself, but for the entire cryptocurrency industry. The question is, will this move lead to greater legitimacy of cryptocurrencies in the global financial landscape? Only time will tell.